us japan tax treaty social security

EST on Thursday November 6 2003 in the Treasury Departments Cash Room 1500 Pennsylvania Avenue NW. You would list the foreign SS benefits on line 16a and 16b of the Federal 1040 form.

What No Tax Treaty Between The Us And Singapore Means For Expats

Security taxes to both the United States and Japan for the same work.

. To claim a provision in the United States Japan Tax Treaty besides claiming US tax credits expats should use IRS form 8833. B in the case of the United States the Federal income taxes imposed by the Internal Revenue Code but excluding social security taxes hereinafter referred to. Up to 85 of US Social Security payments may be considered taxable income in both the US as well as in Japan.

I live in Japan and I have a few questions about US tax on my foreign social security pension. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. An agreement effective October 1 2005 between the United States and Japan improves Social Security protection for people who work or have worked in both countries.

Japan has an extensive tax treaty network. Social Security in Japan. This tax funds things like welfare health insurance workers compensation unemployment insurance and pension plans.

Japan - Tax Treaty Documents. The Security Treaty between the United States and Japan was a treaty signed on 8 September 1951 in San Francisco California by representatives of the United States and Japan in conjunction with the Treaty of San Francisco that ended World War II in Asia. The US and Japan have a tax treaty in place to help US expats who reside in Japan avoid double taxation and determine which country to pay taxes to and when the taxes will be due.

Japan and the United States of America on Social Security Japan and the United States of America Being desirous of regulating the relationship between them in the field of social security Have agreed as follows. EST on Thursday November 6 2003 in the Treasury Departments Cash Room 1500 Pennsylvania Avenue NW. This November Ill turn 63 and qualify to start receiving a Japanese Social Security-like national pension.

I the income tax. In the US the treaty applies to federal income taxes excluding the accumulated earnings tax personal holding company tax and social security tax. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

It helps many people who without the agreement would not be eligible for monthly retirement disability or survivors benefits under the Social Security system of one or both countries. However a foreign social security payment may also be taxable in the United States if you are a US. 68 conventions cover 76 jurisdictions.

The reporting requirements for claiming tax treaty benefits on Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b are not discussed. Article 17 Pension in the US Tax Treaty with Japan. Usually expats pay taxes into the Japanese Social Insurance system after they start employment with any Japanese company.

The Japanese-US tax treaty provides that SS benefits by either country are only taxed by the country of residence. The complete texts of the following tax treaty documents are available in Adobe PDF format. Or local authority of the United States levies a tax similar to the local inhabitant taxes or the enterprise tax in Japan in respect of the operation of ships or.

Archived ContentTreasury Secretary John Snow and Ambassador Ryozo Kato the Japanese Ambassador to the United States will hold a signing ceremony for the new US-Japan income tax treaty at 430 pm. If you work as an employee in Japan you normally will be. Here is a link to Japan-US tax treaty social security benefits covered in Article 23.

Expats on temporary assignments must pay into the US Social Security system too. The treaty covers the Japanese income and corporation tax and US federal income taxes excluding social security tax. Treasury Secretary John Snow and Ambassador Ryozo Kato the Japanese Ambassador to the United States will hold a signing ceremony for the new US-Japan income tax treaty at 430 pm.

Treaties provide that social security payments are taxable by the country making the payments. Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments beneficially owned by a resident of a Contracting State shall be taxable only in. In all cases see the treaty for details and conditions.

Jurisdictions with an underline have tax conventions in Japan which were formed primarily to eliminate double taxation and prevent tax evasion and avoidance. Most income tax treaties have special rules for social security payments. Nevertheless the Treaty is an important document for US.

This article uses the current United StatesCanada income tax treaty text posted by Canadas Department of Finance. In addition to Japans domestic arrangements that provide relief from international double taxation Japan has entered double taxation treaties with more than 50 countriesjurisdictions to mitigate double taxation and allow cooperation between Japan and overseas tax authorities in enforcing their. And ii the corporation tax hereinafter referred to as Japanese tax.

Expatriates in that it does outline. The treatment of pensions as provided for in the US-Japan Tax Treaty is just one of the many one-sided tax benefits available to Japanese citizens living in the US vis-a-vis the Japanese government but denied to US. Under the agreement if you work as an employee in the United States you normally will be covered by the United States and you and your employer will pay Social Security taxes only to the United States.

Learn more about the US-Japan tax treaty. The Room will be available for pre-set at 330 pm. Citizens living in Japan vis-a-vis the US.

A in the case of Japan. Here is a link to Japan-US tax treaty social security benefits covered in Article 23. The Government of Japan and the Government of the United States of America.

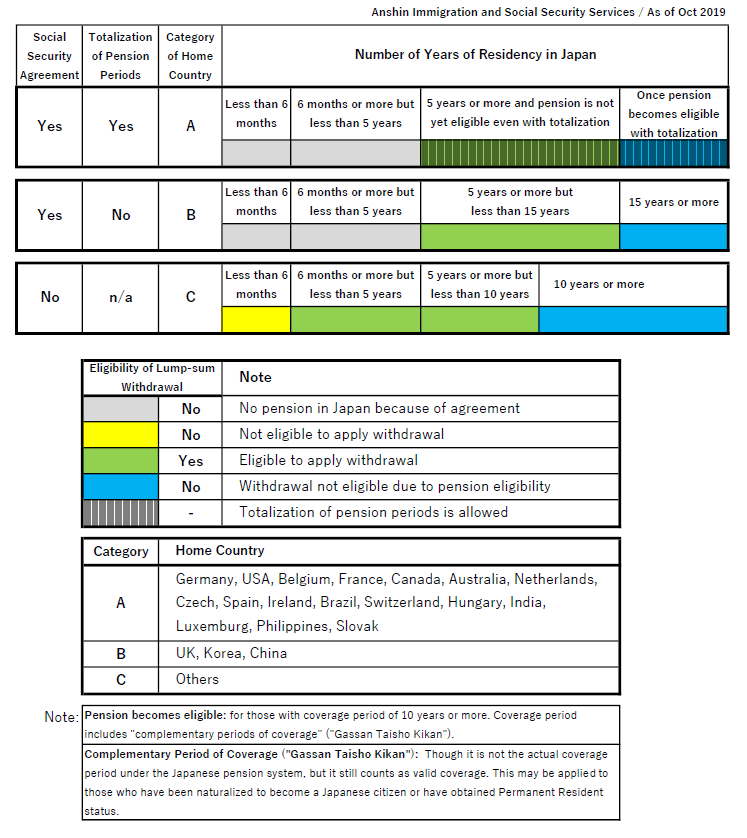

It is in place to help relieve double taxation of dual citizens. For the purpose of this Agreement a United States means the United States of America. The US-Japan Totalization Agreement A separate agreement called a Totalization Agreement helps US expats in Japan not to pay social security taxes to both the US and Japanese governments.

Citizen or resident as a result of the saving clause. The US Japan tax treaty is useful for defining the terms for situations when it is unclear to which country taxes should be paid. 3 Pensions and other income Most pension distributions are considered taxable income in both countries other than from certain qualifying plans such as.

The Federal income taxes imposed by the Internal Revenue Code but excluding social security taxes. As of 14 December 2021 Japan has tax treaties with the following countries. The Room will be available for pre.

The country that receives the tax payment is usually determined by the taxpayers resident status in each country. For ease of illustration lets say it converts to exactly US10000year. The treaty determines which country taxes are to be paid to by using residency status but the treaty can be complex and certain taxes and informational forms are required for both countries regardless.

Form 8833 Tax Treaties Understanding Your Us Tax Return

Lump Sum Withdrawal Relationship With Social Security Agreement Anshin Immigration Social Security

Employee Benefits In Japan Export To Japan

Japan Inheritance Tax For Expats

Us Expat Tax For Americans Living In Japan All You Need To Know

A U S Japan Dual Citizen Arrangement Can Benefit Both Countries Tokyo Review

What Us Expats Need To Know About Totalization Agreements

Form 8833 How To Claim Tax Treaty Benefits H R Block

Us Expat Taxes For Americans Living In Japan Bright Tax

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

The U S Canada Tax Treaty Explained H R Block

Us Expat Taxes For Americans Living In Japan Bright Tax

Social Security Totalization Agreements

Us Tax Tips For American Expats Who Retire In Japan Bright Tax

Should The United States Terminate Its Tax Treaty With Russia